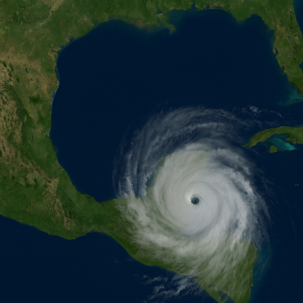

Every year, Louisiana braces for hurricane season, but in 2025, the risk is higher than usual. Recent projections show that Baton Rouge is among the U.S. cities most likely to be impacted by tropical storms or hurricanes this year.

With warming ocean temperatures and more intense weather patterns, the Gulf Coast is expected to experience stronger and more frequent storms. For homeowners in South Louisiana, that means it's time to prepare now—not when a hurricane is already forming.

Why This Year’s Outlook Matters

The 2025 forecast points to an above-average number of named storms, including major hurricanes that could affect our area. Cities like Baton Rouge are especially vulnerable due to their proximity to the Gulf and low-lying topography.

But it’s not just the storm itself that causes damage. The real challenge often comes afterward—when homeowners file claims and face delays, denials, or lowball settlement offers from insurance companies.

Protect Your Home and Your Claim

Preparing for hurricane season isn’t just about boarding windows and stocking up on bottled water. It’s also about protecting yourself legally and financially after the storm passes. Here are a few key steps you can take now:

Review your insurance policy. Understand what is covered and what is excluded. Remember, wind and flood coverage are often separate.

Take photos and video of your property—both inside and out—before hurricane season begins.

Keep digital records of your insurance policy, home inventory, and important contacts stored online or in the cloud.

Document everything after the storm, including damage, repairs, and communications with your insurance provider.

What If Your Claim Is Denied or Underpaid?

Unfortunately, it's common for insurance companies to delay or underpay claims—especially when disaster strikes on a large scale and adjusters are overwhelmed.

That’s where we come in.

At Joubert Law Firm, we help homeowners hold insurance companies accountable. If your claim is denied, delayed, or underpaid, you don’t have to accept it. Our team understands the law, knows the tactics insurers use, and is ready to fight for the compensation you deserve.

Get Help Before or After the Storm

Whether you’re preparing ahead of time or already dealing with hurricane damage, we’re here to help. The sooner you understand your rights, the better protected you’ll be—physically, financially, and legally.

Contact Joubert Law Firm at 225-761-3822 today for a free consultation. We’ll help you navigate the claims process and make sure your insurance company keeps its promises when it matters most.